Deciphering the Banking Sector: A Complete Information to TradingView Charts

Associated Articles: Deciphering the Banking Sector: A Complete Information to TradingView Charts

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Deciphering the Banking Sector: A Complete Information to TradingView Charts. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Deciphering the Banking Sector: A Complete Information to TradingView Charts

The banking sector, a cornerstone of any developed economic system, presents a novel and complicated panorama for merchants. Understanding the nuances of its efficiency requires a eager eye for element and the power to interpret monetary information successfully. TradingView, with its highly effective charting instruments and huge information library, gives a sturdy platform for analyzing financial institution shares and different monetary devices inside the sector. This text delves into the intricacies of using TradingView charts for efficient banking sector evaluation, overlaying key indicators, chart patterns, and techniques.

Understanding the Banking Sector’s Distinctive Traits:

Earlier than diving into chart evaluation, it is essential to understand the precise traits that distinguish the banking sector from others. Banks are inherently leveraged establishments, that means they function with a major quantity of borrowed capital. This leverage amplifies each income and losses, making them inclined to vital volatility, significantly throughout financial downturns or durations of regulatory uncertainty.

Key elements influencing financial institution efficiency embody:

- Curiosity Fee Sensitivity: Web curiosity margins (NIMs) are extremely delicate to rate of interest adjustments. Rising charges usually profit banks, whereas falling charges can squeeze profitability. Analyzing the yield curve and anticipating rate of interest actions is essential for financial institution inventory buying and selling.

- Credit score Danger: The standard of a financial institution’s mortgage portfolio is paramount. Excessive ranges of non-performing loans (NPLs) can considerably affect profitability and even threaten solvency. Monitoring NPL ratios and credit score high quality indicators is crucial.

- Regulatory Surroundings: Banks function underneath strict regulatory oversight. Adjustments in rules, reminiscent of stricter capital necessities or new compliance requirements, can affect profitability and operational effectivity. Staying abreast of regulatory adjustments is essential.

- Financial Circumstances: The general well being of the economic system considerably influences financial institution efficiency. Recessions, financial slowdowns, and geopolitical occasions can all affect lending exercise, credit score high quality, and investor sentiment.

- Geopolitical Elements: Worldwide banks are significantly inclined to international occasions. Political instability, forex fluctuations, and commerce wars can all have an effect on their operations and profitability.

Leveraging TradingView’s Options for Financial institution Inventory Evaluation:

TradingView supplies a complete suite of instruments for analyzing financial institution shares. Efficient utilization entails combining totally different chart sorts, indicators, and drawing instruments to construct a holistic understanding of value motion and underlying fundamentals.

1. Chart Sorts:

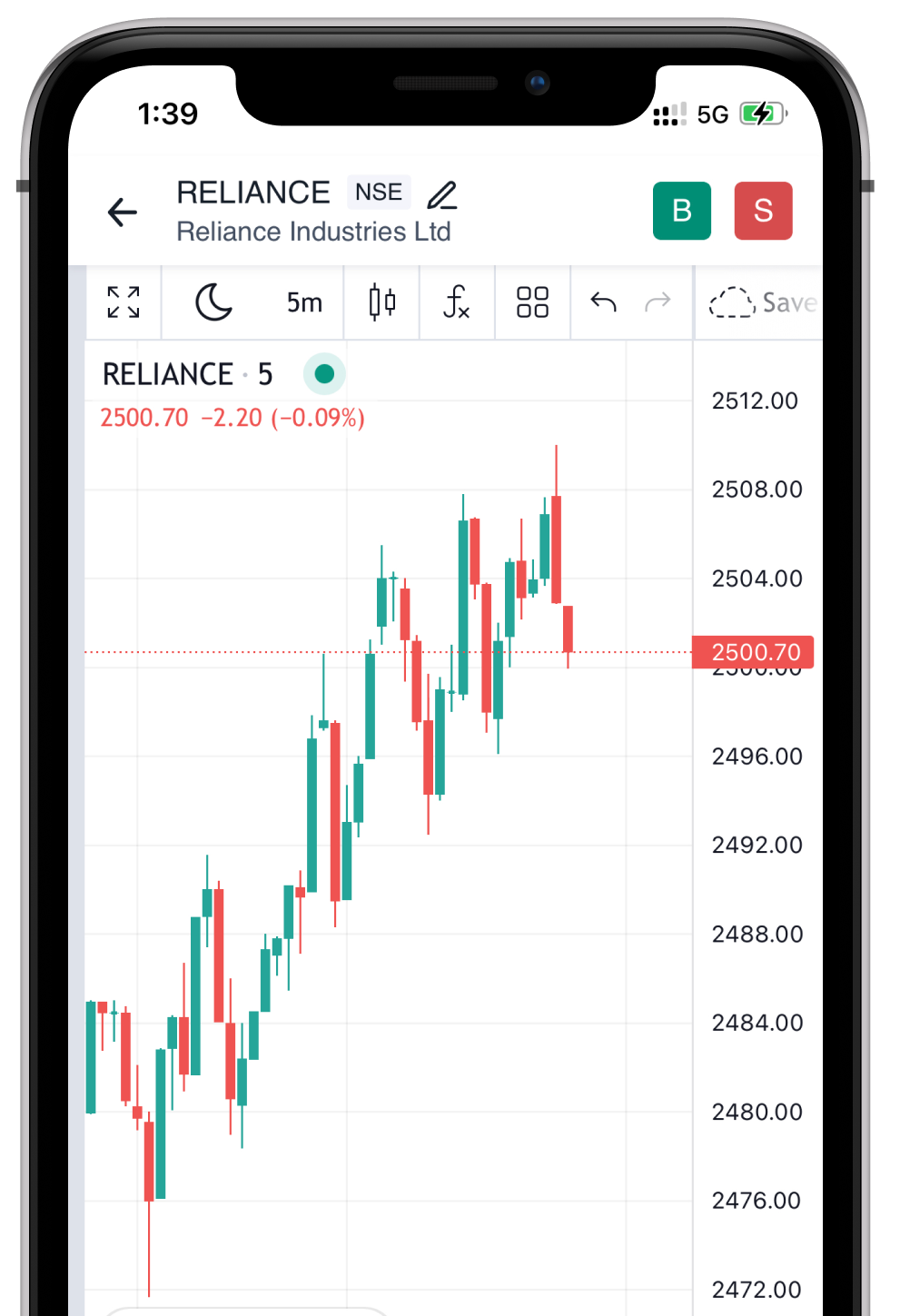

- Candlestick Charts: These are the commonest chart sort, offering visible illustration of value actions over time, together with open, excessive, low, and shutting costs. Figuring out candlestick patterns (e.g., hammer, engulfing patterns) can present insights into potential value reversals or continuations.

- Line Charts: These simplify value actions, highlighting tendencies and making it simpler to establish help and resistance ranges.

- Bar Charts: Much like candlestick charts, however they symbolize value actions with vertical bars as a substitute of candles.

2. Key Indicators:

TradingView gives an enormous library of technical indicators. For banking sector evaluation, some significantly helpful indicators embody:

- Transferring Averages (MA): Determine tendencies and potential help/resistance ranges. Generally used MAs embody easy shifting common (SMA), exponential shifting common (EMA), and weighted shifting common (WMA).

- Relative Energy Index (RSI): Measures the magnitude of latest value adjustments to guage overbought or oversold circumstances. RSI values above 70 counsel overbought circumstances, whereas values under 30 counsel oversold circumstances.

- MACD (Transferring Common Convergence Divergence): Identifies adjustments in momentum by evaluating two shifting averages. Crossovers of the MACD line and sign line can sign potential purchase or promote indicators.

- Bollinger Bands: Present value volatility and potential overbought or oversold circumstances. Worth breakouts from Bollinger Bands can sign robust value actions.

- Quantity Indicators: Analyze buying and selling quantity to verify value tendencies and establish potential divergences. On-balance quantity (OBV) and cash circulate index (MFI) are generally used quantity indicators.

3. Drawing Instruments:

TradingView’s drawing instruments are important for figuring out key ranges and patterns:

- Assist and Resistance Traces: Determine value ranges the place the value has traditionally struggled to interrupt via.

- Pattern Traces: Join value factors to visually symbolize the prevailing pattern.

- Fibonacci Retracements: Determine potential help and resistance ranges based mostly on Fibonacci ratios.

- Channels: Determine value ranges inside which the value tends to fluctuate.

4. Basic Information Integration:

TradingView integrates with numerous monetary information suppliers, permitting merchants to overlay basic information straight onto their charts. This contains:

- Earnings Experiences: Analyze the affect of earnings bulletins on inventory value.

- Monetary Ratios: Monitor key monetary metrics like Worth-to-Earnings (P/E) ratio, Return on Fairness (ROE), and Web Curiosity Margin (NIM).

- Information Sentiment: Gauge market sentiment in direction of particular banks via information headlines and articles.

5. Backtesting Methods:

TradingView’s Pine Script permits customers to create and backtest buying and selling methods. That is essential for validating buying and selling concepts and optimizing parameters earlier than deploying them in reside buying and selling. Backtesting may also help assess the historic efficiency of varied methods inside the banking sector, contemplating totally different market circumstances.

Methods for Buying and selling Financial institution Shares on TradingView:

A number of methods might be employed when buying and selling financial institution shares on TradingView:

- Pattern Following: Determine robust uptrends or downtrends utilizing shifting averages, pattern strains, and different indicators. Enter lengthy positions throughout uptrends and quick positions throughout downtrends.

- Imply Reversion: Determine overbought or oversold circumstances utilizing RSI, Bollinger Bands, or different oscillators. Enter quick positions when the value is overbought and lengthy positions when the value is oversold.

- Breakout Buying and selling: Determine value breakouts from help/resistance ranges, pattern strains, or channels. Enter lengthy positions on upside breakouts and quick positions on draw back breakouts.

- Basic Evaluation Mixed with Technical Evaluation: Mix basic information (e.g., earnings stories, monetary ratios) with technical evaluation (e.g., chart patterns, indicators) to establish high-probability buying and selling alternatives.

Danger Administration:

Buying and selling financial institution shares entails vital threat. Efficient threat administration is essential:

- Place Sizing: By no means threat greater than a small share of your buying and selling capital on any single commerce.

- Cease-Loss Orders: Use stop-loss orders to restrict potential losses on every commerce.

- Diversification: Do not put all of your eggs in a single basket. Diversify your portfolio throughout totally different banks and different asset courses.

Conclusion:

TradingView gives a strong platform for analyzing the banking sector. By combining chart evaluation, technical indicators, basic information, and efficient threat administration, merchants can enhance their possibilities of success. Nevertheless, it is important to keep in mind that no buying and selling technique ensures income. Steady studying, adaptation, and disciplined threat administration are essential for long-term success on this dynamic and complicated market. Bear in mind to totally analysis and perceive the precise dangers related to every financial institution and the general market circumstances earlier than making any buying and selling selections. The data offered on this article is for instructional functions solely and shouldn’t be thought of monetary recommendation. Seek the advice of with a certified monetary advisor earlier than making any funding selections.

Closure

Thus, we hope this text has offered precious insights into Deciphering the Banking Sector: A Complete Information to TradingView Charts. We thanks for taking the time to learn this text. See you in our subsequent article!